how to reduce taxable income for high earners australia

The second largest source. For single filers if your 2021 taxable income was 40400 or.

Tax data is also subject to changes in the definition of taxable income from time to time.

. Income tax surcharge on high salaries The. If this is also happening to you you can message us at course help online. Timing is key to reduce tax liabilities.

On 25 February 2004 the Treasurer released A more flexible and adaptable retirement income system as part of Australia s Demographic Challenges announcement. The progressivity of the tax and transfer systems. If your taxable income is more than 90000 or 180000 combined as a couple or family and you dont.

Tax rate includes Medicare Tax of 38 for top earners. Individuals may purchase health insurance to cover services offered in the private sector and further fund health care. The Medicare Levy Surcharge is a tax levied on high earning Australians who dont have private health insurance.

Most people wont have to worry about Roth IRA income limits but if youre a high earner keep these in mind so you dont accidentally wind up with a. Of revenue was social insurance and retirement receipts at 873 billion or 34 of the total. Australias tax and transfer systems are highly progressive.

Since 1937 our principled research insightful analysis and engaged experts have informed smarter tax policy at the federal state and global levels. The Tax Foundation is the nations leading independent tax policy nonprofit. Federal income tax brackets.

The income tax year is broadly 1 July to 30th June. Those earning between 45001 and 120000 pay 5092. However it can be more distorting for particular groups of taxpayers such as low income earners or the second income earner in a family or high income earners with the ability to plan their tax affairs.

Corporation income taxes accounted for another 13 followed by other revenue at 4 and excise taxes at 3. The OECD has noted that simply shifting large amounts of money from high income earners to low income earners. 2 Note that the de minimis rule would generally apply to individual holders institutional investors such as mutual funds generally amortize market discount into current income as taxable income.

For 2014 revenues the tax credit was increased to 1135 euros for single people and 1870 euros for couples. Health is a state jurisdiction although national Medicare funding gives the Australian or Commonwealth. Health care in Australia is primarily funded through the public Medicare program and delivered by highly regulated public and private health care providers.

Another exception is dividends earned by anyone whose taxable income falls into the three lowest US. Whenever students face academic hardships they tend to run to online essay help companies. Amongst other things this report proposed to allow access to a person s.

This is a cut-off date so any income earned or expenses incurred during this time are included in that year. 3 Assuming the highest marginal tax rate of 434 as ordinary income from price accretion. In Australia income tax varies depending on how much a person makes.

So there are some Australians who are subject to a 33 income tax rate. We can handle your term paper dissertation a research proposal or an essay on any topic. Superannuation Government co-contribution for Low Income Earners Act 2003 no.

This makes planning the timing of your income and expenses a. Shows changes in the share of income received by the top 1 05 and 01 per cent of income earners in Australia from 1921 until 2010. The amount of taxable income or revenu fiscal de référence RFR is not equal to the income received by the household in the year.

Save time and effort by comparing a range of Australias health funds with iSelect. Low earners income tax credit. Find out how it affects you.

Individual income taxes were the largest single component amounting to 12 trillion or 47 of the total. We will ensure we give you a high quality content that will give you a good grade. For example the top 25 or top 50 of earners might see their benefits reduced whereas benefits for lower-income Social Security recipients would remain intact.

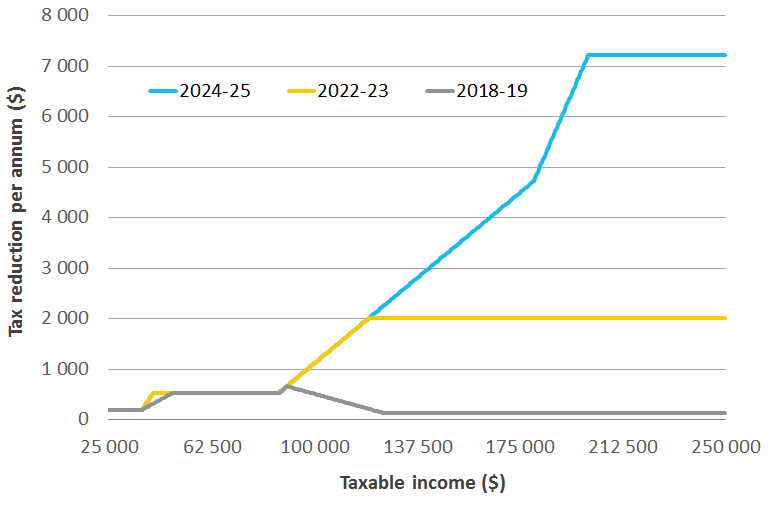

Personal Income Tax Cuts And The Medicare Levy Parliament Of Australia

How Do Taxes Affect Income Inequality Tax Policy Center

Bracket Creep Will Increase Average Tax Rates Most For Middle Income Download Scientific Diagram

How Do Taxes Affect Income Inequality Tax Policy Center

Are Elasticities Of Taxable Income Rising In Imf Working Papers Volume 2018 Issue 132 2018

Northern European Countries That Call Themselves Democratic Socialist Seem To Have Relatively Low Corporate Tax Rates And High But Flat Non Progressive Personal Income Tax Rates Is This Accurate What Else Do They

How Do Taxes Affect Income Inequality Tax Policy Center

Are Elasticities Of Taxable Income Rising In Imf Working Papers Volume 2018 Issue 132 2018

How Do Taxes Affect Income Inequality Tax Policy Center

How To Calculate The Tax In Australia Quora

Reduce Taxable Income Smart Ways To Save More Money Easi Australia

Tax Minimisation Strategies For High Income Earners

Good Morning Taxable Income Earners Everyone Wants To Reduce Their Tax Right So One Simple Way To Determine If You Ca Virtual Assistant Income Tax Deductions

How Do High Income Earners Reduce Tax In Australia Imagine Accounting

How Much Income Tax Do We Really Pay An Analysis Of 2011 12 Individual Income Tax Data Parliament Of Australia

8 Ways On How To Reduce Taxable Income For Individuals In Australia Box Advisory Services

/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)

How Do 401 K Tax Deductions Work

Extension Of The Low And Middle Income Tax Offset Lmito Parliament Of Australia